Member-only story

Here is What Inverted Yield Curve Means for Your Portfolio

Recession, Market sell off or stocks will rally?

If you have turned on the news in the past few days, specially on business channels such as CNBC and Bloomberg, you would have noticed that almost everybody is speaking about the yield curve. Part of the yield curve has inverted which has caused a lot of debate in the financial markets.

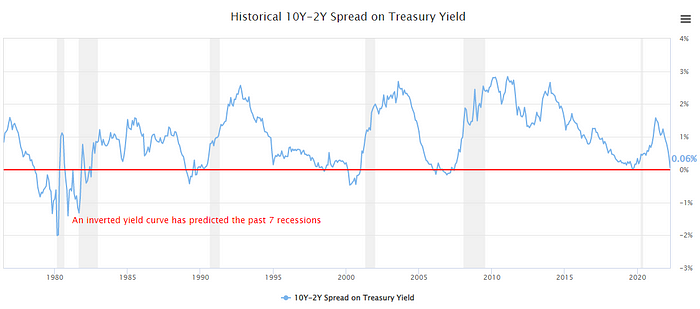

The inverted yield curve has correctly predicted last 7 recessions and the yield curve is an important leading indicator into health of the economy.

Almost every investor pay close attention to this indicator.

In this article, I will discuss three key subjects:

- What is yield curve and what does a healthy yield curve look like.

- Is this inversion a big deal?

- What could be the best trade if we head into a recession.