How Often Should We Re-Optimize Trading Strategies?

And survive the ever changing market dynamics!

Parameter optimization is an important part of developing any trading strategy. However, not long after optimization the strategy falls short because of changes in market dynamics.

Is re-optimization the answer? If the answer is a resounding yes, then the obvious question is “well, how often do we optimize?”; is every week too much? What about every month?

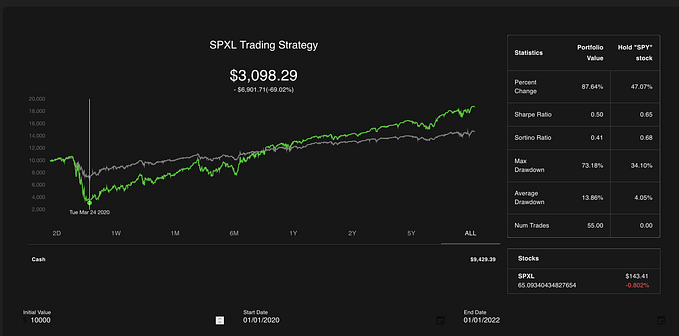

Clearly, this is not going to be a one size fits all type of investigation, but from my analysis, for a strategy on a daily time-frame we should optimize every 6–12 weeks. Here is an example where I re-optimize a moving average crossover trading strategy on the S&P500 index:

Besides the absolute classic buy-and-hold approach, the best performer was re-optimizing every 12 weeks; however, I’d argue that the 6 week re-optimization does rather well too! In all circumstances, the optimized strategies come out on top of the classic moving average crossover strategy (labelled as the “Baseline”).