The Phoenix of Silicon Valley: How Oracle Reinvented Itself for the AI Age

From Database Giant to Cloud Powerhouse: Larry Ellison’s Billion-Dollar Gamble on AI Supercomputing

Two weeks ago, Project Stargate was inaugurated. There was definitely a lot of work that happened behind the scenes for this. At the announcement, there were three tech leaders: Sam Altman (OpenAI CEO), Masayoshi Son (SoftBank CEO), and Larry Ellison (Oracle CEO).

What? Larry Ellison?!?

I know. It’s been a while since we’ve heard that name mentioned in technology circles, which are these days dominated by social media tycoons or cloud provider titans.

At the Stargate launch event, Donald Trump referred to Larry Ellison as the “CEO of everything”.

So, let’s ask the question.

How did a CEO who’s been patiently working behind the scenes suddenly get thrust into the limelight?

Oracle in 2022

Just recently, in 2021, when the stock market was in one of its volatile bouts, I read an article about Oracle’s slide from its dominant position in the database market. A position it once considered its stronghold.

In fact, Oracle lost business to other, more nimble competitors. Post that, they laid off a bunch of people in 2022 since their database market was shrinking.

Why was this happening?

Well, to start with, the public cloud was all of a sudden looming over the techno-verse accelerated by an unexpected pandemic. The rush to keep systems up and running in such a gloomy environment caused companies to accelerate moving some of their workloads onto the cloud. The acronym (Software as a Service) SaaS, got a big foothold into the game, and before you knew it, applications were moving to the cloud faster than you could say .. cheese !!

But what were Oracle’s challenges?

The startup ecosystem was thriving, but these newer players were experimenting with a lot of other tech on the cloud: -

- NoSQL: — Databases like MongoDB, and Cassandra were gaining customers at the cost of old-school RDBMS players like Oracle.

- SaaS Model: — The SaaS model allowed users to deploy applications and not worry about the underlying infrastructure. For years, Oracle’s brand of database involved making their customers hire expensive DBAs to maintain them. Now, there were systems where such heavy lifting was automated and otherwise delegated to another team to handle. The phrase Managed Services comes to mind.

- Cloud Dominance: — The three leading cloud players have made it very easy to onboard new clients onto the cloud. Initially, Oracle’s latest database was unavailable on these leading cloud players, making migration to competing vendors easier.

Oracle had to pivot, but in such a volatile environment, the battle needed to be fought on multiple fronts.

Oracle’s Big Gamble — OCI

Running a public cloud business is one of the most expensive endeavors on the planet.

If you disagree, look at IBM’s public cloud!

What? IBM’s public cloud?!? See, I bet you didn’t know that IBM has its own public cloud !! It’s called IBM Cloud, previously known as Bluemix.

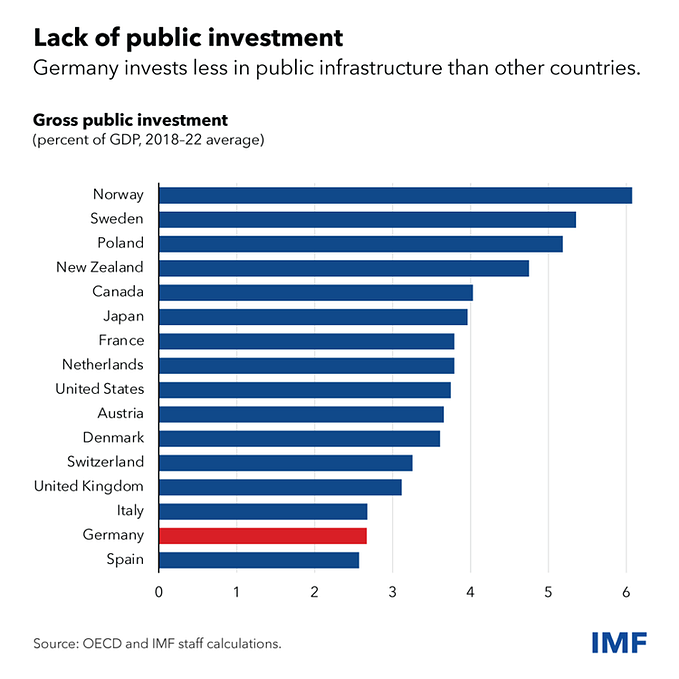

We normally only hear of the 3 Giants — AWS, Microsoft, and Google, who have sliced up the entire cloud market between them and have left the remaining crumbs for the rest.

I have written a separate article about this here.

Operating a public cloud across a nation, region, or globe costs billions of dollars. With so much at risk, Oracle still decided to jump into the cloud game and build its own public cloud, Oracle Cloud Infrastructure (OCI).

There are many reasons why this could have gone very wrong.

- Private Cloud: Building your own brand of cloud that, for the majority of the time, runs your own software is counter to what the rest of the industry is doing. Microsoft Azure, for instance, has its own database, a datalake, and other products, but it is in first-party agreements with other vendors such as Databricks, Snowflake, and even Postgres. The competition between the cloud provider and its vendors is healthy. With Oracle, though, it wasn’t very straightforward, so you see fewer SaaS vendors on OCI than on Google, Azure, or AWS. Oracle is working to improve this, though.

- Infrastructure Rising: The last two years saw an acceleration in infrastructure spending for the public cloud with the advent of Generative AI and the projected cost of running all those AI factories. Even social media giants such as Meta and X have amped up their spending over the last few years. Oracle was a giant, but it had a smaller global data center footprint.

Here’s how Oracle turned the corner.

Oracle’s Secret Sauce — Enterprise Applications

Building huge data centers across regions at the scale the three cloud providers were doing didn’t make sense for them — well, at least not initially.

Oracle decided to focus on its strengths — Enterprise Clients.

Enterprise clients run their businesses very specifically in their domains, most of the time locked in their silos with products ranging from the archaic to the most cutting edge.

The enterprise in 2023 was a mess. Too many new products jostled for space at the counter while trying to displace the older vendor products to the backrooms of history. Security, authorization, privacy, and a host of governance issues began to dominate the space.

Being a database company, Oracle already had this baked into their pie.

Then, they realized that their application business was killing it with customers. Growth for this segment has been quite impressive. If you look at Oracle’s messaging nowadays, OCI, Netsuite, and others bring in the much-needed cash flow for them.

In fact, it isn’t strange today to hear an advertisement for Oracle that does not mention its traditional database.

Looking at it from that angle, Oracle has morphed into a SaaS provider with extensive technology support.

Oracle — TikTok Play

I couldn’t leave this out for sure.

When TikTok ran into trouble with the American Government some years ago, Oracle jumped into the fray and agreed to house the app’s data in the US. This was a bonanza. In 2022, all US consumers’ TikTok data was stored on Oracle servers on OCI. This was a big win.

Oracle needed a high-value client for its fledgling cloud platform and it got just that.

This strategic move by Oracle was always going to be touch and go. Of course, it was a go when Trump assumed office. His penchant for rewarding American companies has not gone unnoticed. Trump sees Larry as a battle-scarred technology warrior who has stood the test of time.

It remains to be seen whether Oracle will take a sizeable stake in TikTok, but even if that happens, it would probably be for all the right political reasons.

Oracle — The Supercomputer

This was another gambit.

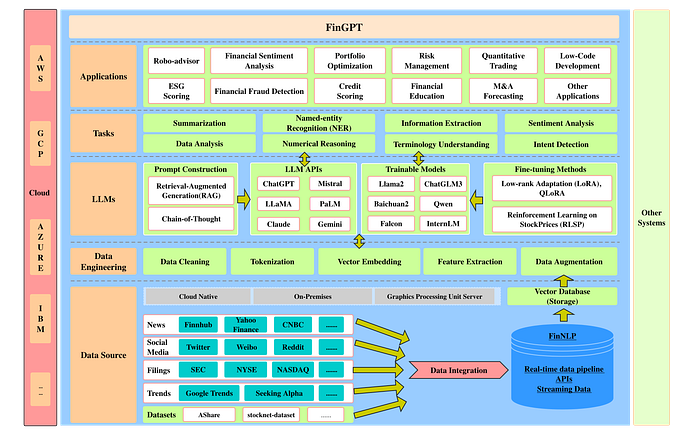

When the other main cloud providers bought GPUs from NVIDIA last year, Oracle decided to build a supercomputer powered by NVIDIA’s GPUs.

These GPUs cost a ton, along with the supercomputer.

Oracle’s decision to build a supercomputer was a strategic move to set itself apart in the competitive cloud market. This infrastructure bump gave them ultra-fast networking and automated data centers, leading to increased AI model training and lower computation costs.

Last year, at the 2024 NVIDIA GTX conference, Jensen Huang called out all three providers for collaborating with his GPU product lineup. Oracle was also mentioned as a result of its supercomputer.

In fact, they’re already building the next supercomputer.

Summary

Oracle’s transformation demonstrates its ability to adapt to changing market dynamics. It leverages its enterprise expertise while embracing new technologies like AI and cloud computing.

Like all success stories, there is inherently a level of risk. It is safe to say that their gambit with cloud computing has been paying off till now.

Takeaway: In the fast-paced world of tech, Oracle’s journey proves that even established giants can reinvent themselves and emerge as leaders in new frontiers.

Visit us at DataDrivenInvestor.com

Subscribe to DDIntel here.

Join our creator ecosystem here.

DDI Official Telegram Channel: https://t.me/+tafUp6ecEys4YjQ1